Join The Free Live Training!

Thursday, March 20th 2025, 8AM PT | 11AM ET

ONLY For Business Owners Who Earn 1 Million+ Annual Gross Revenue Between All Businesses Combined

Discover The Legal Risk-Mitigation & Business Expansion Tool That 92% of Fortune 500 Companies Use & That Your CPA & CFO Are Overlooking

That has nothing to do with Real Estate, Moving To A New State Or Country, Or Shell Companies

Your Going To Learn:

How to duplicate the business expansion strategy 92% of Fortune 500 companies use by leveraging this ONE tool to turn unknown business risks into a legal investment vehicle

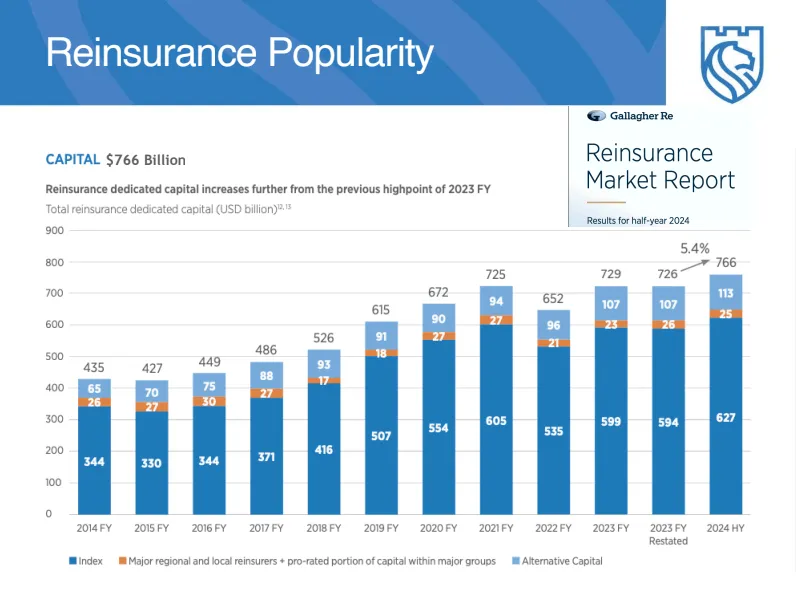

Exactly why this ONE risk mitigation & business expansion tool grew by 40 billion+ just last year and why now is one of the best times in history to use it

How our sovereign nation domicile provides protection & privacy for the $700 Million+ we've managed for clients over the past 25 years

LIVE Show-Up Bonus:

Our '9-Figure Leverage Training' that breaks down the BEST way to deploy leverage and scale your business beyond 7-figures

"But... Is This Training Right For ME?"

Most likely, YES! Especially if at least ONE of these Statements Feels True For You....

You earn at least $1 million+ annual gross revenue collectively across all your businesses (This is an absolute requirement if not please leave this page)

You want a legal, safe, and secure way to reduce your tax liability using the same tool 92% of Fortune 500 companies leverage

If you have a network of $1 million+ annual gross revenue business owners, that you would like to refer and by doing so you will gain an "I Owe You" for sharing a profound yet little known business strategy

You want to unlock a business expansion tool that gives every business in your portfolio increased leverage

You are already earning $1 million+ annual gross revenue collectively across all your business and desire minimize losses while maximizing revenue growth

If you even said a small "yes" to any of the above, then YES! Your a perfect fit for the Live Training that was designed to help you create a full-time income by sharing Christian content online.

From: Steven Chasteen

To: The $1M+ Business Owner

What if I told you the secret to my business success....

...from coming from an average middle class family to licensing my patents to big oil & gas companies and running an 8-figure construction company....

Was all from ONE risk mitigation & business expansion tool?

Seriously - ever heard a shark on Shark Tank see an give an entrepreneur a credit line with interest?

They're most likely using this tool. It's called reinsurance.

In fact....

92% of Fortune 500 Companies use some for of Reinsurance and we're going to show you exactly how you can too during this training

Let's face it - public companies have used discretionary tax advantages to maximize shareholder value for years.

With one little caveat....

These strategies sometimes border the legal line, ruin the integrity of their companies, and are only useful until too much attention is drawn to them...

Then law makers shut them down.

However...for Reinsurance Specialties, there is no grey area in integrity.

...That wealthiest businesses understand that the best way to increase their net worth outside of increasing your revenue is to reduce your tax liability

But that's easier said than done, here's why....

In today's business game, depending on who you ask, "What's the best way to minimize business risk & increase revenue...?"

You probably will get a different answer from each person...

The single entrepreneur with no kids will say, "Move to Dubai or a now income tax state and reinvest this additional revenue."

The more seasoned, yet outdated entrepreneur might say, "Invest in captive insurance..."

But for us, after working with billion dollar businesses, the answer is the same every time: Reinsurance

What if I could teach you how to apply the same risk mitigation & business growth strategy that grew by $40 BILLION just last year, not in one month...

...BUT In Just ONE HOUR?!?!

That would be an absolute no brainer right?

But what if I also told you that...

This strategy provides the ultimate protection for your family and kids to continue the entrepreneur path of success

This strategy allows you to become your OWN lender with your own rates to fund most new businesses, initiatives, or personal ventures

This strategy actually gives you JOY about taxes because you will finally learn how to leverage the tax incentive structure at a 9-figure+ level.

This strategy give you the FREEDOM to aggressively scale your business

This strategy would be 100% done-for-you by a mature, experienced, and well seasoned team that has been successfully executing for their clients for 25+ years

Join Me (Steve Chasteen) For A Once-In-A-Lifetime Event That Could Change The Entire Trajectory Of Your Entrepreneurial Career...

How To Turn Business Risk

Into An Investment Vehicle!

When you say "yes" and join the training for free today, we'll show you, in just 1 hour (including Q&A), how to easily and legally turn your business risk into tax advantage premiums, then leverage these premiums to invest in business expansion

OUR CLIENTS SAY

“We vetted many servicing companies before landing on this reinsurance platform. They have been extremely helpful in introduction, education and connections with unrelated, third party operational teams. We are extremely happy with our reinsurance model."

"Reinsurance is a beautiful business tool used to help control business risk exposures surrounding our ten LLCs; we remit tax-advantaged premium monthly and enjoy mitigating our collective risks."

"Team members of the Reinsurance Specialties™ organization are responsible, trustworthy and approachable professionals. Me and my fellow medical professionals are strategically self-insuring our under-insured risks (and protecting our assets) relative to our practices, real estate properties and business holdings outside the practice."

Jeff M

Florida

Morgan J.

New York

Stuart T.

Oklahoma

© 2024 by Reinsurance Specialties PORC insurance and alternative risk transfer planning involves sophisticated insurance and risk management issues, regulatory and corporate legal issues, federal, state and usually international tax issues, and a wide range of accounting and financial issues. This planning is specific to each set of circumstances. It is not appropriate to apply general information described herein to any particular situation. The formation of a captive is a part of a client’s implementation of alternative risk transfer planning, and is dwarfed by its ongoing operations. As a result, this planning should not be undertaken without a competent team of professionals who have extensive experience in alternative risk transfer planning.The information herein is general in nature, and may not be relied on for any specific use. The content herein (including graphics) does not purport to show all details and complexity in establishing a compliant alternative risk transfer program. Reinsurance Specialties™ is not engaged in rendering legal services or advice.

Disclosure under IRS Circular 230: The information and services offered are not intended to and do not comply with the U.S. Treasury Department’s technical requirements for a formal legal opinion, and cannot be used by a taxpayer to avoid any penalty that might be imposed on a taxpayer. Nothing herein may be used in promoting, marketing or recommending an investment plan or arrangement.